Kiranas and Online Retailers Can Work Together to Overcome Challenges

[Excerpts from “Online Retailing Paired with Kirana—A Formidable Combination for Emerging Markets” by Prof. Piyush Kumar Sinha, Srikant Gokhale and Saurabh Rawal in Customer Needs and Solutions (2015) 2:317-324]

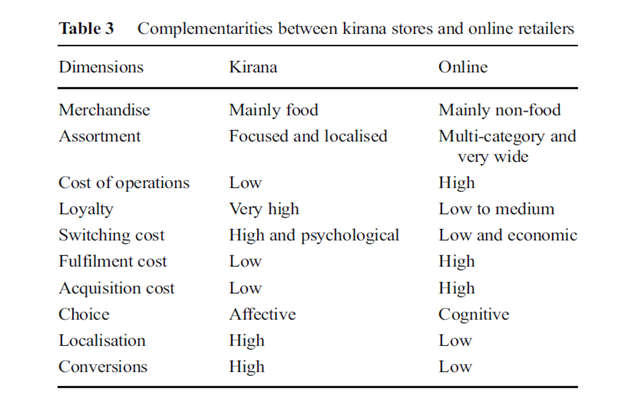

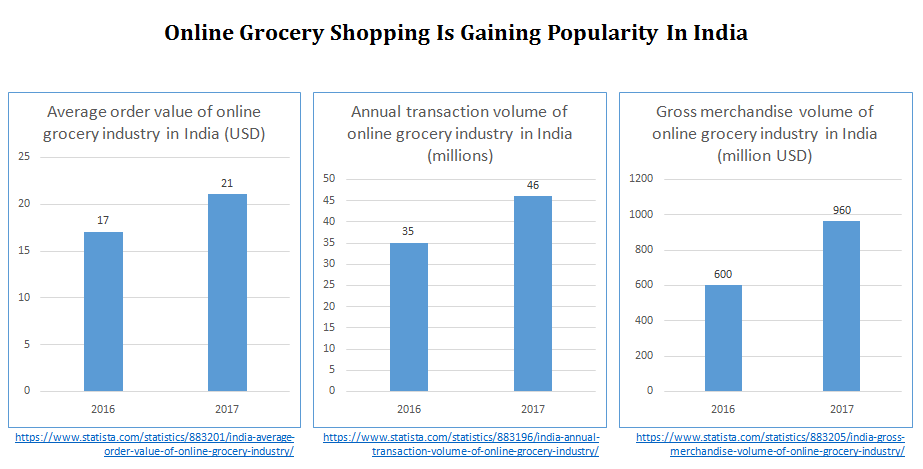

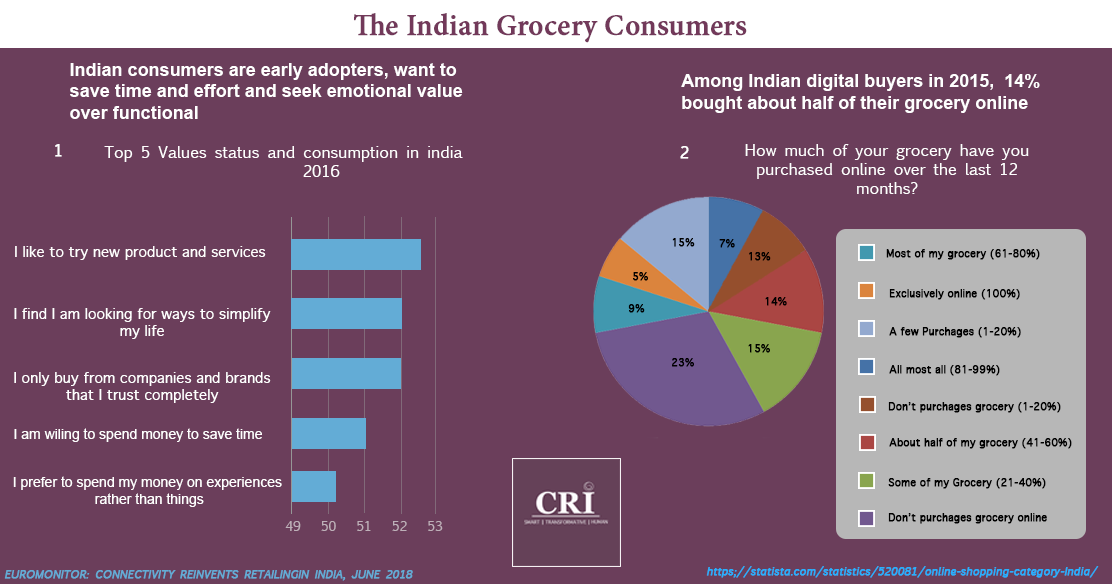

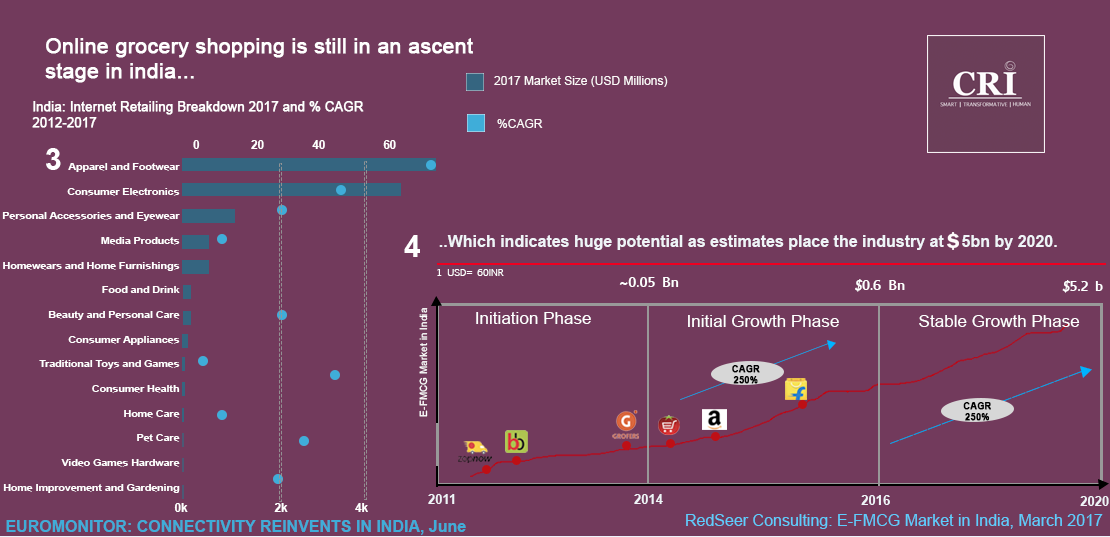

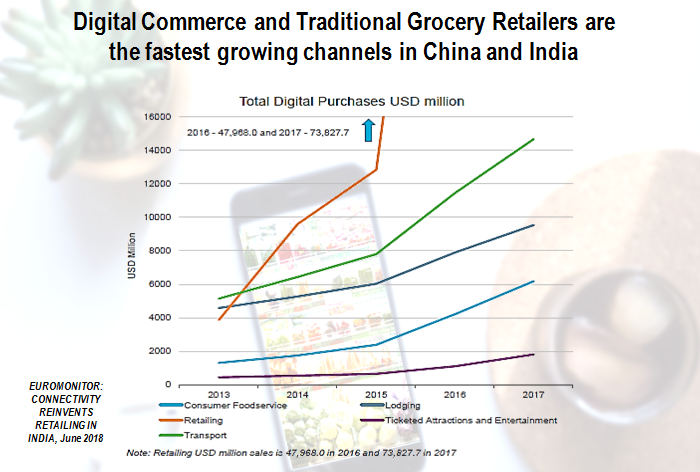

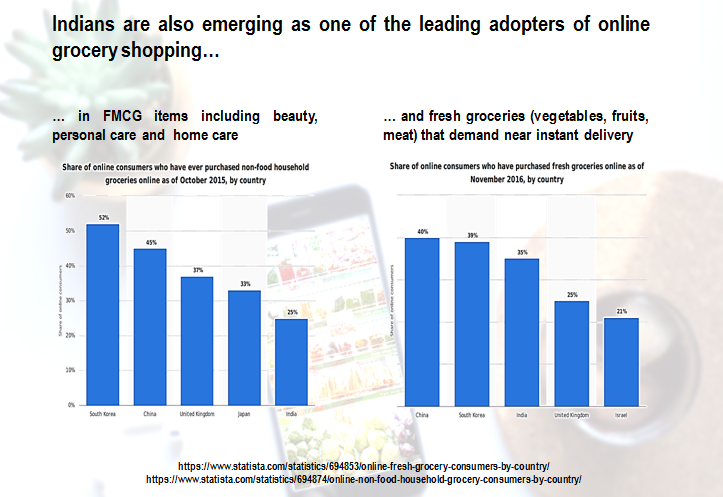

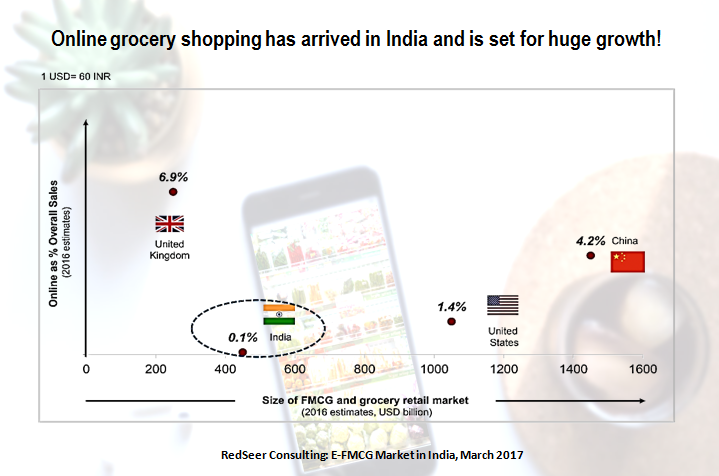

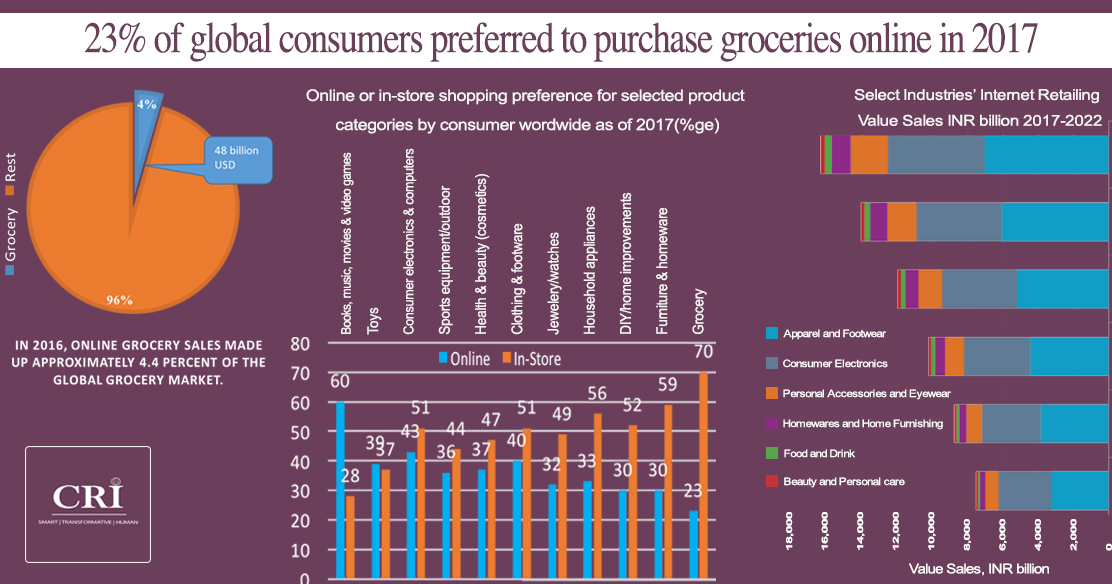

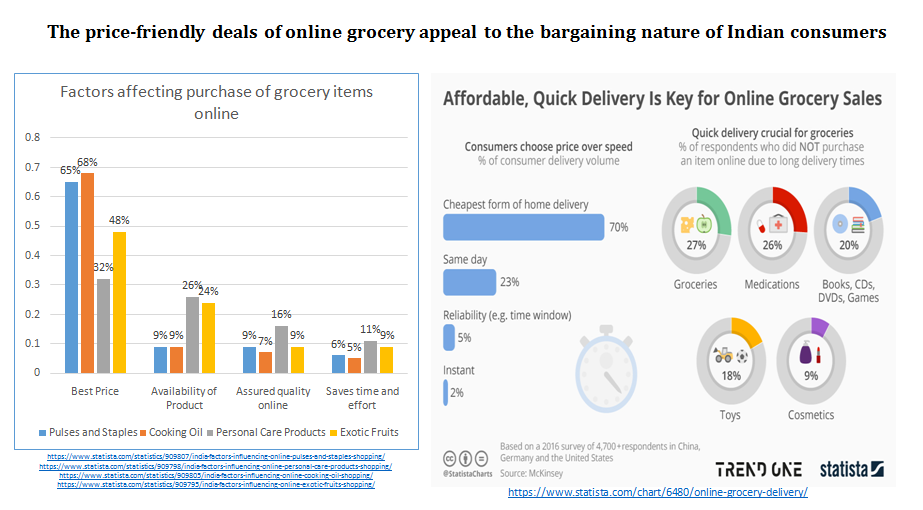

So far, most online retailers operating in India are selling non-grocery products. Numerous reasons for this exist. Food shopping involves purchasing a basket of goods [1] that may be both perishable and heterogeneous [2]; it is also subject to habits, everyday routines and a host of related activities like meal planning, preparation and cooking [3]. Food purchases are necessary, repetitive and seasonal, and many customers like to physically touch goods before buying. Although most kirana stores sell dry groceries and packaged goods, touch becomes important when customers buy grains, cereals and pulses and especially vegetables and fruit. Finally, grocery products tend to have a low value-to-weight ratio [4], leading to higher cost of fulfillment and warehousing.

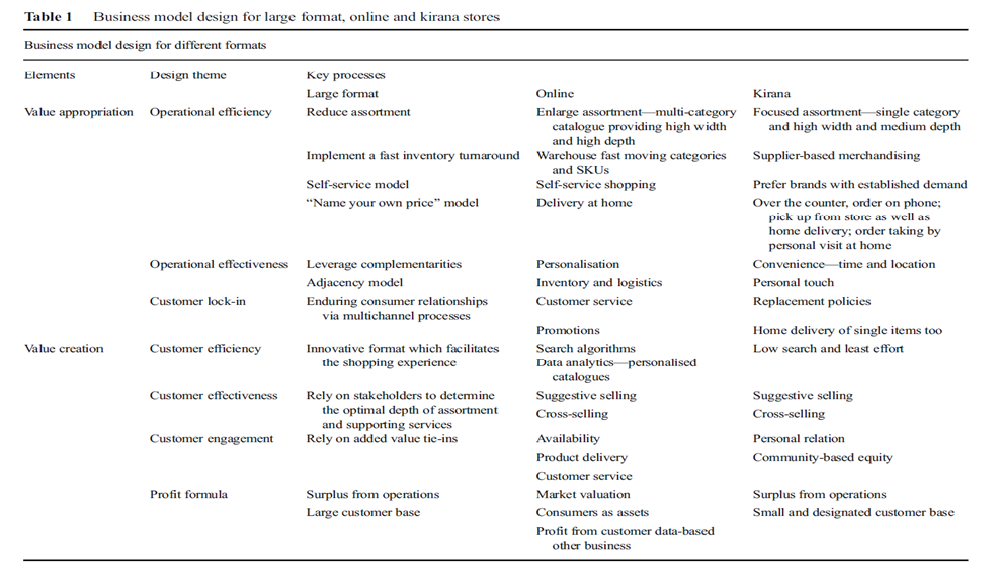

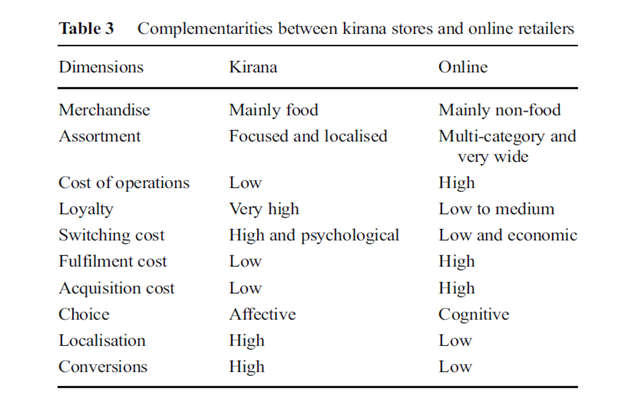

Kirana stores and online stores complement each other as they offer many similar values, with kirana stores providing localisation and online providing personalisation and choice.

The heterogeneity of the consumer basket can be managed by partnering with multiple kiranas; this would also build a larger basket size. Some online retailers have started supplying fruit, vegetables, eggs, milk, dry groceries, and ice cream from different stores to the same customers. Online retailers can add value by bringing the benefits of being a marketplace. Besides getting a larger assortment to choose from, consumers can still buy from their primary kirana store. In addition, they can choose from any other store nearby in case of nonavailability at their regular store. Each kirana can benefit from an e-store, for which they have neither the resources nor the capability to create for themselves. The challenge that online stores face is delivery, as these orders will be serviced by different stores and the deliverers from these stores may arrive at the customers’ premises at different times. How long and what kinds of customers would patronise these online stores is yet to be established.

Kirana stores could become pick-up points for customers ordering online. However, due to the small size of most stores, they will not be able handle large numbers of orders. Nevertheless, kirana stores can equip themselves with the technology to receive orders from internet-enabled devices such as tablets and mobile phones. The ubiquitous kirana can enhance its accessibility to consumers through the medium of the internet, resulting in a larger catchment area for each store. The online retailer will be able to reduce its inventory, delivery and other overhead costs.

Online grocery stores selling to a targeted and more geographically concentrated customer segment through kiranas may reach profitability faster than larger ones due to their smaller catchment/fulfilment area. However, retailers will need to address the challenges of resource constraints, channel integration issues, staff support difficulties and cultural issues in integrating the two formats [5]. As the scale of business through online stores is not very large, they are being tested even by the kirana stores. Currently, the expectation from kirana stores is not high since the responsibility of customer acquisition as well as delivery is with the online retailers. Channel integration and conflict issues will emerge when online

retailers gain scale; companies that develop plans to manage these situations will benefit in future. Another point on which online retailers need to focus is servicing a large number of scattered customers, which will require strict checks on customer acquisition and fulfillment costs. In other products, these become tenable with scale; in the case of groceries, a new business model will have to be developed which is modular, profitable at smaller scale and easily replicable.

References:

- Gronow J, Warde A (2001) Introduction. In: Gronow J, Warde A (eds) Ordinary consumption. Routledge, London, pp 1–8

- De Kervenoael R, Soopramanien D, Elms J, Hallsworth A (2006) Exploring value through integrated services solutions: the case of egrocery shopping. Managing Service Quality 16(2):348–445

- Miller AD (1998) Theory of shopping. Polity, Cambridge

- Raijas A, Tuunainen VK (2001) Critical factors in electronic grocery shopping. International Review of Retail, Distribution and Consumer Research 11(3):255–265

- Lewis J,Whysall P, Foster C (2014) Drivers and technology-related obstacles in moving to multichannel retailing. International Journal of Electronic Commerce 18(4):43–67

Related Resources:

- Brand adoption by BoP retailers, Prof. Piyush Sinha, Suraksha Gupta and Saurabh Rawal, Qualitative Market Research: An International Journal Vol. 20 No. 2, 2017 pp. 181-207 Available for download

- Format Choice of Grocery Retailers, Prof. Piyush Sinha, Elizabeth Mathew and Ankur Kansal, 2005 Available for download

Advisory, Training, Research| Retail & Ecommerce| Healthcare| Infrstructure| Luxury & Lifestyle| Entrepreneurship|